Well hello again! Have you been considering purchasing your new home, possibly your forever home, but you just aren’t quite sure what to do with your current home? If so, then you are in the right place my friends. Below I will detail a powerful tool that you may be able to take advantage of, a contingent offer!

What is Equity?

The first concept to wrap your head around, when considering a contingent offer is the equity you have in your current home. You’ve probably heard the term equity thrown around all over the place, but what does it actually mean? The simple answer is that equity is the difference between what you purchased your home for and what it is worth today. But, there is some added nuisance to this.

The correct way to determine your equity is to subtract how much you owe on your home from its value on the current market. When you have a mortgage, part of your payment goes to paying off the principal on your loan. So, with every payment you make, you are actually adding to your equity. When you couple your payments with how much your home value appreciates year-over-year, you start to see how powerful equity and homeownership really are!

Let’s use my home as an example of calculating equity to illustrate this point. My fiance and I purchased our home for $412,000 in July 2021. We used a 5% down conventional loan, so our downpayment was $20,600. Which put our initial loan balance at $391,400 ($412,000-$20,600=$391,400). 19 months later and our current loan balance is $379,300. So, since we purchased our home we have gained $12,100 ($391,400-$379,300=$12,100) in equity, just by paying our mortgage every month! We could realistically list our home for $480,000 today so the total equity we have gained since we purchased our home is just over $100,000 ($379,300-$480,000=$100,700).

Understanding Net Proceeds

Ok, so we’ve established how to calculate how much equity you have in your home, which is a great start! However, equity isn’t real dollars that you hold in your hand, it’s potential value for you to tap into. And this is what you leverage when considering utilizing a contingent offer. Like anything else in this world, there are fees involved when you want to tap into your equity called seller closing costs. That’s what net proceeds take into consideration. This calculation actually comes from the sales price of your home, so (Sales Price) – (Seller Closing Costs) = Net Proceeds.

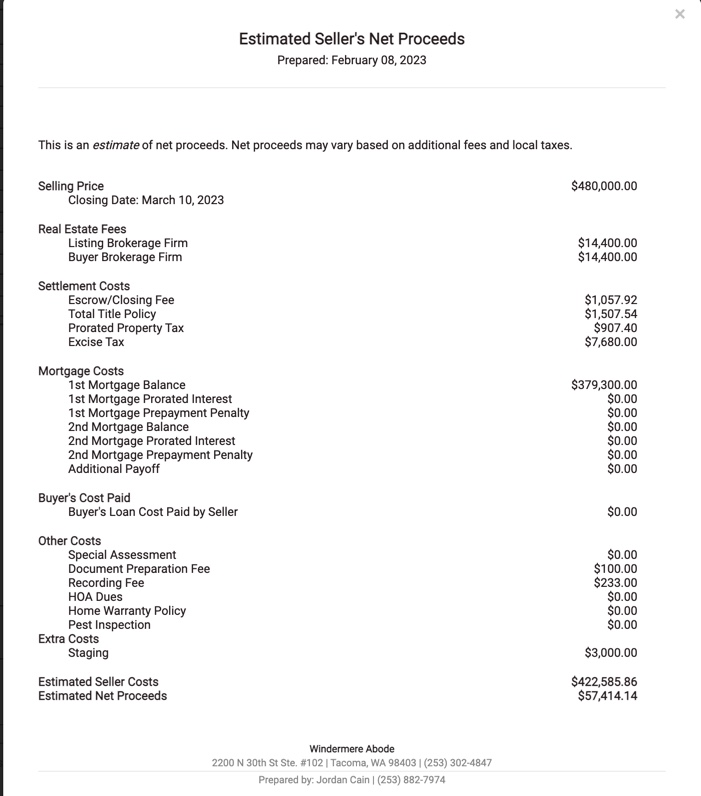

We’ll use my home here again as an example. In order to purchase your new home, you will need to sell your current home and pay your seller closing costs in the process. Those closing costs included: loan payoff, real estate compensations, title and escrow fees, excise tax, prorated property taxes, and listing prep costs. So your net proceeds will look something like this:

So if we decided we wanted to purchase a new home with a contingent offer we would have roughly $57,000 to put toward that new house. And that’s only after 19 months of living in our home. More equity means more net proceeds and then more potential purchasing power for your next home!

How Contingent Offers Work

Alright, so here we are! Sorry to put you through all that numbers talk, but it’s important that you understand those topics in order to see if the contingent route would even be right for you. Now let’s cover what that process looks like! You’ve found a house you love and submit your contingent offer, and the Seller accepts! Now what? Once the Seller accepts, you now have five business days to get your home listed on the market. And the standard period of time you will have to fully sell the home is 45 days. This number can be changed, but 45 days is a great reference point.

The main unique characteristic of contingent offers is called a “Bump Clause”. This is very important to remember and understand for all contingent Buyers. When a Seller accepts your offer initially, that home will change its status online from being “Active” to being “Contingent”. When a non-contingent offer is accepted the status will change to “Pending”. The Seller may keep the property on the market, and continue to allow showings to other prospective Buyers.

This is where the “Bump Clause” can potentially come into play. If the Seller receives another legitimate offer that they would prefer to move forward with, before your home is under contract, they can send you a bump clause notice. If that were to happen, you would have five business days to find a Buyer for your home. If you cannot and don’t wish to waive your contingency then the contract would terminate, and the Seller would be free to move forward with the other party.

If all goes to plan, the transaction for your home will close first, and then you would complete the sale of your new home three days after. There is a litany of scenarios that can happen anywhere along the way, but hopefully, it will all be smooth sailing for you. Things however do go wrong from time to time. That’s why working with an experienced Realtor to help you navigate this process is a must! I hope this didn’t confuse you too much, and that this information was useful. If you have any questions about contingencies, the market, or tips for buying and selling homes please feel free to reach out. I’m always happy to help!

-J Cain

Text/Call: (253) 882-7974

Email: jordancain@windermere.com

Instagram: @jcainhomes

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link