Hello, again folks! I hope you’re all doing well and sticking to your goals for 2023 so far 👍🏾. As you may or may not know, my fiance Sam and I purchased our first home together in July 2021. We receive monthly market and home appreciation updates from a wonderful program called Homebot. This is a great way to keep tabs on your home appreciation with the monthly emails you receive. There are also a lot of great tips and tricks you can play around with in each monthly report. One of the most important things it helps with is tracking your PMI, private mortgage insurance!

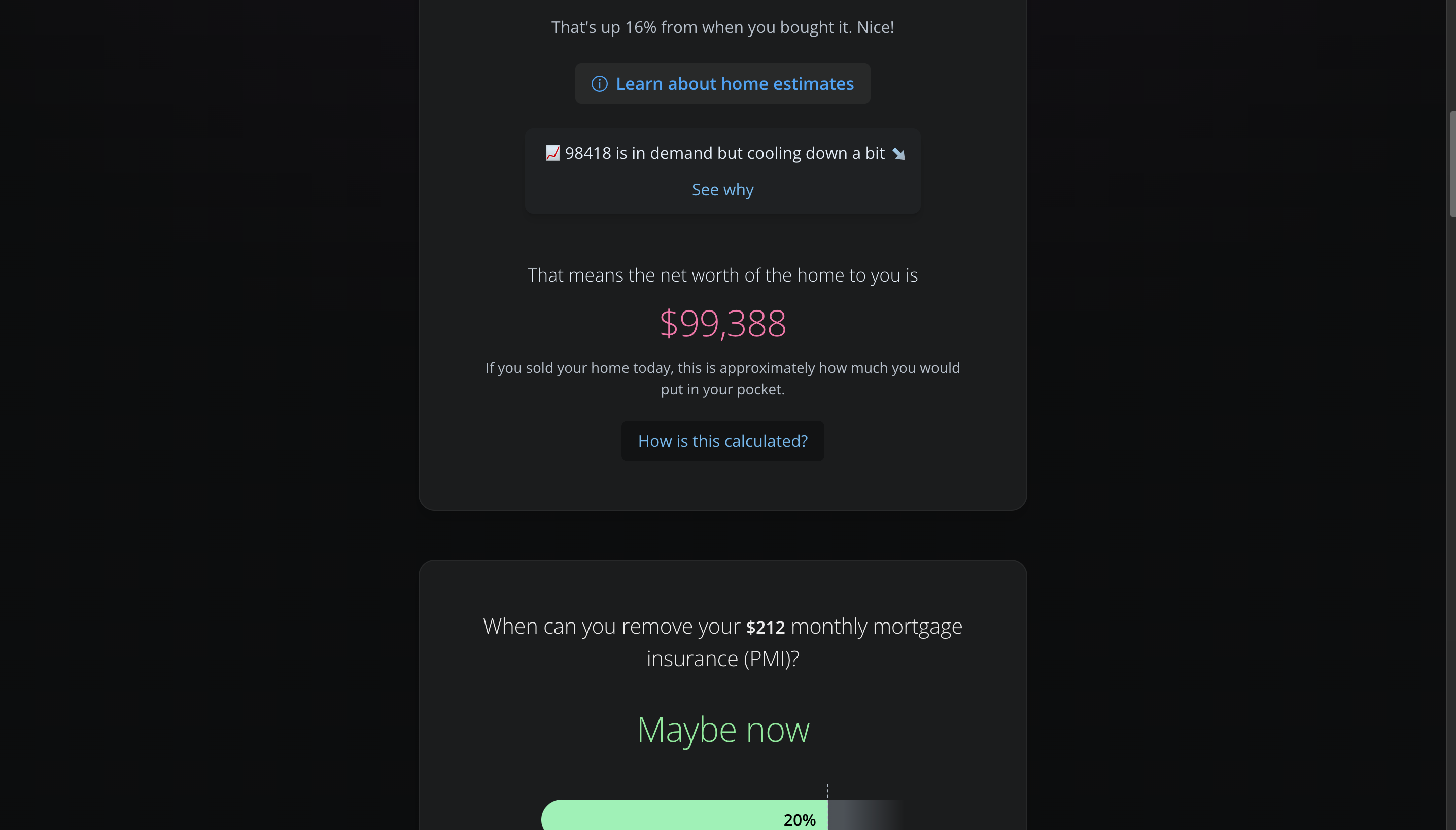

So according to our Homebot updates, we may be able to get our PMI taken off of our mortgage. This would save us around $200 per month on our payment which is $2,400 per year! I’ve also had a few clients inquire to me about getting their PMI taken off, so I needed to do some research on how one can go about doing this. And of course, I’m going to share with y’all what I’ve learned, and how you may be able to take advantage as well!

What is PMI?

The first thing to understand is what PMI actually is, and if you have it on your loan. When you purchase a home with a Conventional or FHA loan and put less than 20% down for your loan, you will almost always be charged PMI as a part of your mortgage. This is insurance that protects your lender if you were to stop making your monthly payments. If you have it, you’re paying for it every month, but it’s not actually to your benefit. So getting it removed as quickly as you can is always a smart play! However, if you used an FHA loan to purchase your home, then the PMI can never be removed. You would need to refinance to a conventional loan in order to be able to take it off. Also, there is no PMI at all for VA loans, which is one of the major advantages of that loan type! I recommend reaching out to your lender to inquire if you have this on your loan and ask them what steps you need to take to remove PMI.

How to Remove PMI

Ok, so we now know what PMI is and who most likely has it on their loans. I would definitely still reach out to your lender to get the ball rolling. But, keep on reading with me here and I’ll outline the different ways to remove PMI. The options below are the standard guidelines laid out to me by our lender, it may be different for you, but this will give you good context on how this works generally!

Automatic Removal: It will automatically be removed when you pay your loan balance down to 78% of the original loan price. For example, our original loan price was $391,400 when we purchased our home. In order for PMI to be removed automatically we would need to pay our loan balance down to $305,292 which is 78%, by paying our mortgage every month. We decrease our loan principal by about $8,000 per year, again by simply paying our mortgage. So it would take us around 10 years of owning our home to reach the automatic removal threshold.

Request Removal: The second way to remove PMI is by requesting it is removed, which is what I think you should be trying to do if you can! In order to go this route you would need to get either an automated valuation or a broker price opinion for your home (BPO). My lender would start with an automated value and, if a BPO were needed, that would only cost $150 to have done! There are three subsets with this option that all have their own criteria.

- Less Than 2 Years Old and Substantial Improvements Have Been Made: The unpaid principal balance on your loan must be 80% or less of the current market value. There would need to be substantial improvements to the property, and a list of improvements would need to be provided for review to determine eligibility for a new valuation. Sam and I have been in our home for under two years. If we wanted to go this route we would need to have done significant improvements to our home (kitchen and bath remodels, converting or adding ADUs, etc). And then we would have our home value updated and that value would need to be within 80% of our loan principle in order to get our PMI off.

- Loans Over 2 Years Old, But Less Than 5 Years Old: The unpaid principal balance on your loan must be 75% or less of the current market value. This is the route that we personally would fit into, and will be considering once we’ve been in our home for two years this July. I bet a lot of first-time buyers would also be in this boat as well! So for us, our loan balance in July will be $375,850. So we would need our home to be valued at $505,000 in order to be within the 75% threshold ($375,850/$505,000=74.4%) Given the improvements we have planned for this year on our house and the current market conditions, I think we could very likely be valued at $505,000 come July. And even if that doesn’t pan out, at worst we’d only have spent $150, and we could always reassess in six months and try again!🤓

- Loans Over 5 Years Old: The unpaid principle balance on your loan must be 80% or less of the current market value. You must have no payments 30 days past due in the last 12 months and no payments 60 days past due in the last 24 months. If you bought a house in Piece County five years ago, I’d be surprised if you weren’t at the 80% threshold given how much the market has appreciated in that time. So this route is much more straightforward. But, this also shows the power of owning your home as a long-term investment, the earlier you get skin the game the more earning potential you have!

Wrapping Up:

I hope this helps you in understanding what PMI is, who most likely has it, and how you can go about removing it from your loan. I really don’t think that anyone should feel bad about not having 20% saved up to put down on their home. Especially first-time buyers, in fact, the median down payment for folks aged 24-41 is 8-10%, according to The National Association of Realtors. We put down 5% on our home and yes, we have had to pay PMI making our mortgage payments higher. But, within two years we may be able to get that removed at a minimal cost to us. We plan on being in our home for at least the next five years, and if we save $2,400 per year that’s $12,000! Money that we would be paying on our mortgage anyways, that we can now invest elsewhere. So if you have PMI on your loan and you think you fit the mold I laid out above, reach out to your lender and see if you can start saving as well!

I’m always available if you have any questions on this topic, or really anything else haha. I’d be happy to help you with updating your current home value or getting you signed up for Homebot, which I know would be such a powerful tool for your homeownership journey. Hit me up at anytime my friends and be easy! 🏡👍🏾

-JCain

Call or Text: (253) 882-7974

Email: jordancain@windermere.com

IG: @jcainhomes

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link